Investors

Climate Infrastructure Funds

Strategy

Portfolio of sustainable infrastructure investments

The investment case is offered by the fundamental transformation needs in existing infrastructure systems to address global climate change, a transition made possible by declining technology costs, new business models, and growing consumer demand.

We aim at building a broad portfolio of sustainable and low-carbon climate investments, in partnership with premier infrastructure fund managers: our Climate Infrastructure Fund will invest in funds, acquire secondary stakes in such funds or vehicles and pursue co-investments alongside fund and industrial partners.

Structured as a capital gains oriented strategy, the fund grants access to differentiated opportunities in the mid-market infrastructure space in Europe and North America, while also providing a strong yield. Expected net IRR is in the 10-12% range with annual cash yields at 4-6%.

Key Features

- Sustainable Investment

- Adequate diversification level

- Fast capital deployment

- Early positive value appreciation

- Competitive feel level

Strategy Characteristics

Optimized portfolio within the climate infrastructure investment space

The fund will be diversified across managers, vintage years, sectors, investment types, and regions

- Sectors: renewable energy, resource/energy efficiency, electric vehicle infrastructure, smart grids & transmission, energy storage & decentralized grids, digital infrastructure.

- Fund investments (primary and secondary), direct/ co-investments

- Core-plus, value-add strategies

- Regions: Europe and North America

Costs

Reduction of total costs compared to traditional fund-of-funds

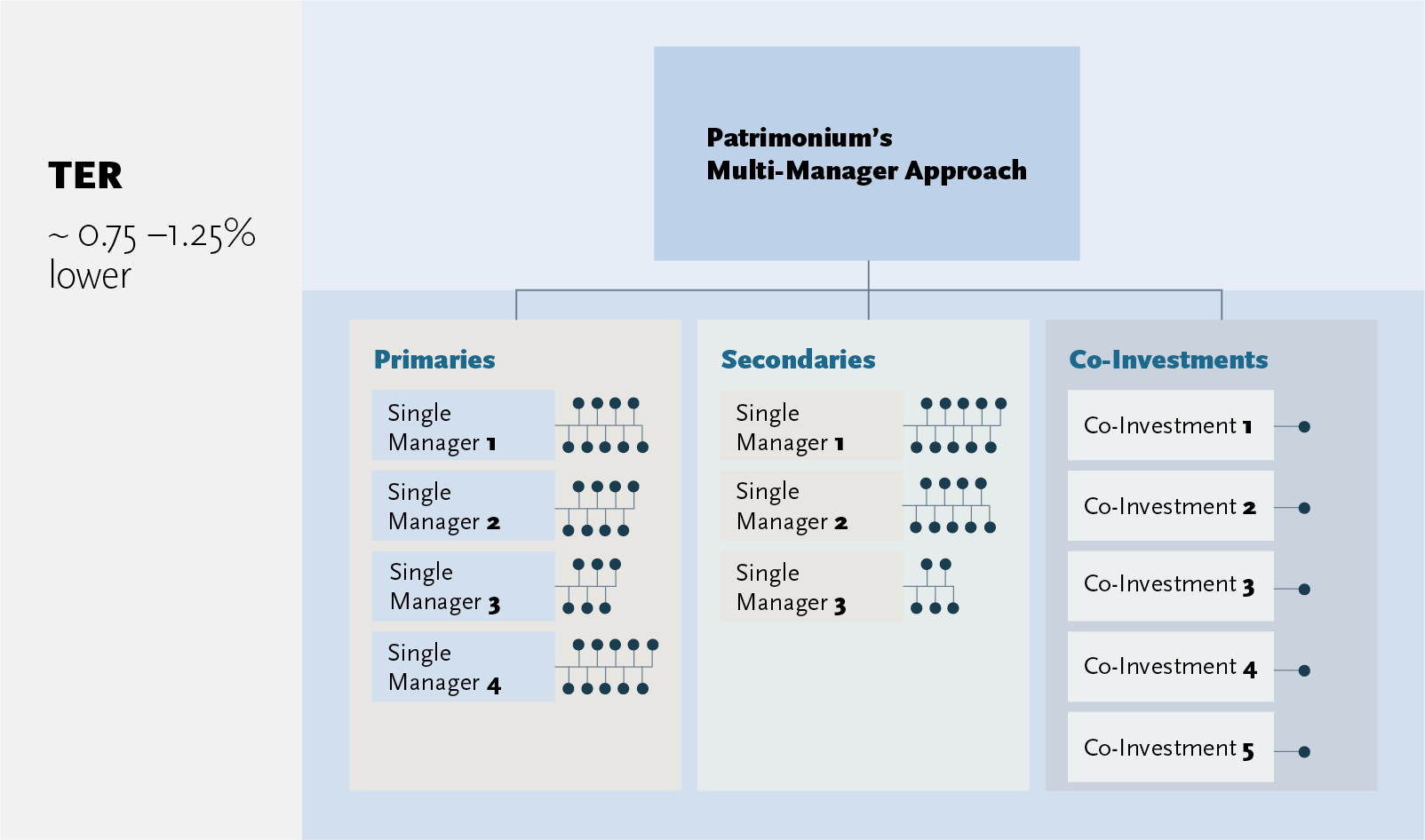

Patrimonium implements infrastructure investments efficiently by combining primaries, secondaries, and co-investments in a targeted manner. The strategy places particular emphasis on co-investments and secondaries, which, based on experience, enables a reduction in total costs of approximately 0.75% to 1.25%. Co-investments can often be executed free of fees or at significantly reduced fees. In secondary transactions, future fee obligations can frequently be fully or partially discounted in the purchase price.

This approach maintains appropriate diversification, enabling attractive return potential while maintaining controlled risk exposure.

EU Sustainable Finance Disclosure Regulation

The EU Sustainable Finance Disclosure Regulation (“SFDR”) went into effect on 10 March 2021. It requires financial market participants such as Patrimonium to provide information to investors on how the firm addresses sustainability risks, considers the potential adverse sustainability impacts of its investments, promotes of environmental and social factors, and adheres to a sustainable investment objective.

Sustainable Investment Objective

The Patrimonium Climate Infrastructure Opportunity Fund aims to meet a sustainable investment objective by contributing positively to climate change mitigation and adaptation in line with the Paris Agreement.

We target key segments of climate infrastructure, including renewable energy, energy infrastructure and storage, energy efficiency, sustainable transportation, and social infrastructure, for which there is strong global demand. Climate infrastructure not only enables sound economic development, job creation, and the purchase of local goods and services, but also improves the quality of life of citizens, helps protect our vital natural resources and the environment, and promotes the more effective and efficient use of financial resources.

Proprietary ESG and Sustainability Framework

We have developed a proprietary ESG and Sustainability Framework that spells out our procedures and policies for evaluating investments according to a specific set of criteria, for assessing and mitigating sustainability risk, and for providing transparency to our clients. The Framework is implemented through a three step approach:

- ESG Negative Screening

- For each potential investment, we screen for ESG risks to help objectively identify material issues. We verify whether the investment is related to any infrastructure sector that does not mitigate climate risk or that conducts any business which is believed to be unsocial, unethical, or unsustainable

- Sustainability Inclusion

- We rate investments along the key elements of sustainability and ESG inclusion practices, which are: sustainability principles, organization, investment process, asset level and reporting. A rating above a set threshold is needed to proceed with an investment.

- Alignment with UN Sustainable Development Goals

- The Fund addresses ten out of seventeen UN Sustainable Development Goals

- The ten goals are: (3) Good Health and Well Being; (5) Gender Equality; (7) Affordable and Clean Energy; (8) Decent Work and Economic Growth; (9) Industry Innovation and Infrastructure; (10) Reduced Inequalities; (11) Sustainable Cities and Communities; (12) Responsible Production and Consumption; (13) Climate Change and (17) Partnerships for the Goals

All ESG and Sustainability ratings of the underlying investments in the Partnership are pooled to give an aggregated rating, which is published annually in the investor Sustainability report, along with the scoring for each underlying investment.

Fund Information PCIOF I (closed)

General Information

Patrimonium Climate Infrastructure Opportunity

Infrastructure Equity

EUR 300m

July 21

EUR

Climate Infrastructure Equity

7-9% p.a.

3-5% p.a.

Professional Investors

12 yrs.

Luxemburg SICAV- RAIF

No leverage at Fund level

Dividend paying fund shares

Art. 9 product (pursuant to EU Regulation 2019/ 2088 of the European Parliament and of the Council of 27.11.2019 on sustainability-related disclosures in the financial services sector)

Technical Information

LU2355509899

115209514

Administration

Patrimonium Asset Management AG

Patrimonium Infrastructure Sàrl

Aztec Financial Services (Luxemburg) S.A.

RBSI

Ernst & Young S.A.

Waystone Management Company (Lux) S.A.

CSSF (Luxemburg)

Elvinger Hoss Prussen, Société Anonyme

Fund Information PCIOF II

General Information

Patrimonium Climate Infrastructure Opportunity II

Infrastructure Equity

EUR 300m

EUR

Climate Infrastructure Equity

10% p.a.

4-6% p.a.

Professional Investors

12 yrs.

Luxemburg SICAV- RAIF

No leverage at Fund level

Dividend paying fund shares

Art. 8 product (pursuant to EU Regulation 2019/ 2088 of the European Parliament and of the Council of 27.11.2019 on sustainability-related disclosures in the financial services sector)

Technical Information

LU2925904406

Administration

Patrimonium Asset Management AG

Patrimonium Infrastructure Sàrl

Aztec Financial Services (Luxemburg) S.A.

RBSI

Ernst & Young S.A.

Waystone Management Company (Lux) S.A.

CSSF (Luxemburg)

Elvinger Hoss Prussen, Société Anonyme

Contacts